Oct 29, 2025

Michelle Mire

What to know about paying yourself while running your business

You started your business to do what you love and earn income to support yourself and your family. This makes sense on so many levels, intellectually and emotionally. But when it comes to giving yourself a paycheque, you have questions, lots of them.

At a recent event, this was one of the things we talked about with entrepreneurs. So believe us when we say you’re not alone.

Since this is one of the most common questions we hear from small business owners across Canada, you deserve a common-sense answer. In this article, we’ll share how your business structure and tax laws factor into this decision.

How some sole proprietors keep it super simple

As your business structure is one of the main factors that affects how you pay yourself as an entrepreneur, many freelancers and service providers operating as sole proprietors opt to report business income on their personal tax returns. Basically, everything just goes into the same bucket.

As your business grows, or if you incorporate, you’ll want to think about how to pay yourself in a way that supports your financial goals and checks all the other real-world boxes. That’s when the question of salary vs. draw comes into play.

What an owner’s draw is and how it works

Nope, it’s not a poker move. An owner’s draw is when you take money directly out of your business profits for personal use. Offering flexibility and simplicity, it’s a common approach for paying yourself as a sole proprietor or within a partnership.

What else you need to know about owner’s draws

The money comes from your owner’s equity — your share of what the business owns after debts are paid, meaning that you’re pulling money out that could otherwise be used to reinvest, handle slow months, or cover future expenses.

You don’t pay taxes when you withdraw the funds, but they count as income when you file your personal tax return.

The flexibility of an owner’s draw should be balanced with the discipline of setting aside funds for taxes.

What a salary is and how it works

A salary is when you literally put yourself on the payroll. You decide what you should earn, then you pay yourself at regular intervals. Most times, owners choose to give themselves a salary when their business is structured as a corporation.

What else you need to know about salaries

When you pay yourself a salary, the funds are recorded as a business expense, which lowers your corporate taxable income, the amount of income your business pays taxes on.

You’ll deduct your income and payroll taxes throughout the year, each time you pay yourself.

A salary’s structure and consistency offer predictable income that makes budgeting and saving easier for both your personal and business needs.

What dividends are and how they work

If you’re a shareholder of an incorporated business, you also have the option of paying yourself through dividends, payments made to shareholders from the company’s after-tax profits.

What else you need to know about dividends

Similar to a solopreneur’s draw, dividends are recorded as retained earnings (profits after corporate tax). This means that paying yourself with dividends affects business equity, taking that money out of the profits and paying it as income rather than reinvesting it in the business.

Dividends are only an option when your business is profitable enough to allow for payments to owners.

For income tax purposes, dividend payments are reported as part of your personal income taxes, where you may also be eligible for the federal dividend tax credit that may lower your personal tax burden.

How to choose the right option for you and your business

Truthfully, there’s no one-size-fits-all answer. How you pay yourself as a business owner depends on your business structure and income needs, along with the level of flexibility or structure you require.

Some business owners even choose a hybrid approach: taking a regular salary for stability, and then occasional draws when profits allow. Similarly, owners of incorporated businesses may combine a salary with dividends. These blended options help balance personal income needs with corporate tax efficiency.

If you’re not 100% sure what’s right, it’s probably a good time to talk with your accountant or bookkeeper. While this article is a quick recap, you’ll want expert advice planning and managing your business and personal income.

How Huumans helps

In this article, we’re talking about paying yourself. And, yes, payroll is one of the tools we offer. But, whether you’re a solopreneur who counts your business and personal income together or you’re leading an incorporated business, Huumans offers you more than a collection of tools: We bring you an entire operating system.

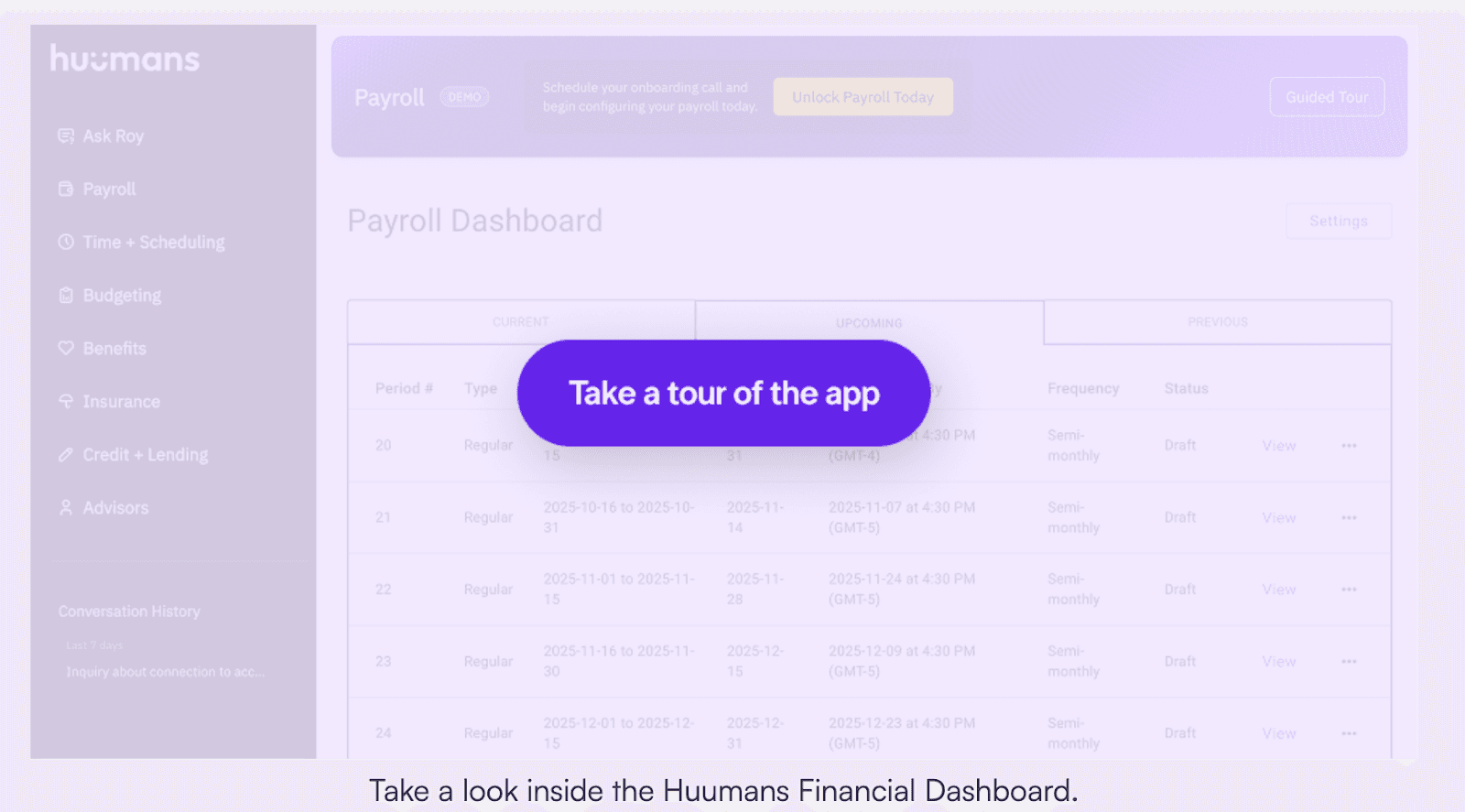

Like the home screen of your laptop or phone, the Huumans Dashboard puts all your financial information at your fingertips. To check it out, simply sign up to get started.

Every small business can use Huumans

I was curious, would Roy, the AI advisor built into the Huumans Dashboard, work with me if I were a solopreneur who didn’t have QuickBooks or Xero? So, I asked if I could share my invoices instead. Roy is so helpful that he even offered to build me a template.

Then I asked if he could advise me on whether or not I should take an owner’s draw. He even outlined the process and told me how he’d look at things, such as modelling cash flow.

But what about payroll?

Huumans Payroll is the first tool we’ve launched inside the dashboard. We’re so excited, we’re letting any Canadian small businesses pay up to 5 employees free for the first year. That means if you’ve been meaning to pay yourself, you can automate your payroll and your tax obligations without extra software fees. Once you add your 6th employee, all you pay is $10 a month for your payroll software.

And with your payroll connected to your financial dashboard, you can ask Roy how your payroll data is impacting your cash flow and budget visibility. He’ll be able to tell you:

When payroll is taken from your business accounts, and when it hits your employee accounts.

How your payroll numbers affect your cash flow forecast for the coming months.

How labour spend compares to your projected revenue.

Click on the image to take a tour.

What’s next?

Budgeting and benefits are coming soon. And we can’t wait for more small businesses to discover an operating system that works for them. We’re also building our network of bookkeeping and accounting advisors so that the human component is always front and centre as part of our brand and your experience.

Resources

Here are a handful of key links that can help you learn more about paying yourself as a small business owner and finding financial clarity.

Huumans blog

CRA

FAQs

Does Roy AI replace an accountant or bookkeeper?

No, Roy AI works as an advisor within the Huumans Dashboard to help you ask questions so you can be even more equipped and informed when you talk to your human accountant or bookkeeper.

How often should business owners pay themselves?

It really depends on your setup and cash flow. If you’re incorporated, it usually makes sense to follow a regular payroll schedule. Sole proprietors often take money out when they need it, but setting a routine can make personal budgeting way less stressful.

Which is better: salary or owner’s draw?

There’s no single “right” answer. Your choice comes down to how your business is set up and how steady your income feels month to month. A salary gives you structure and predictable deductions, while a draw offers more flexibility but takes a bit more discipline to set money aside for taxes.

What’s the difference between a draw and a dividend?

The key difference is business structure. Draws are for sole proprietors and partnerships, while dividends are for corporations. Both reduce equity, but dividends come from corporate profits that have already been taxed.

Can you combine payment methods?

Yes. Many owners use a combination of salary and draws or salary and dividends, depending on their business structure and goals.

Fine print changes all the time. We do our best to keep things accurate and helpful, but this blog doesn’t replace your accountant, bookkeeper, or lawyer. If you catch something off, let us know and we’ll fix it. And if we link to other sites, that’s just us sharing resources — what they say is on them, not us.