Event

Brand

Oct 28, 2025

Michelle Mire

Real businesses, real stories, real people

Our attendance at the 2025 Small Business Summit confirmed one truth above all else. There’s nothing like meeting small business owners in person to hear what you have to say and share how you’re really feeling. Reflecting on these conversations, Huumans Head of Partnerships, Kyle Stinson, and Head of Marketing, Nesh Pillay, wanted to share some of the top takeaways.

Huumans Head of Partnerships, Kyle Stinson & Head of Marketing, Nesh Pillay,

What small businesses wanted to know more about

While excitement was buzzing about the first game of the World Series (Go, Jays!), some of the day-to-day topics that rose to the top included these recurring sentiments.

1. How does payroll work for a solopreneur?

Many entrepreneurs who were teams of one asked how they should pay themselves. They were genuinely curious. Kyle found himself explaining the pros and cons of salary vs. owner’s draw. The key is understanding how each one works, how it will impact your business, and ensuring that you’re following all the rules.

At the highest level: If you pay yourself a salary, you can use payroll software, like Huumans, to do automate calculations and payroll tax compliance. An owner’s draw is treated as a different kind of transaction related to your equity account. (In fact, we wrote an entire blog article on this topic to help answer your questions.)

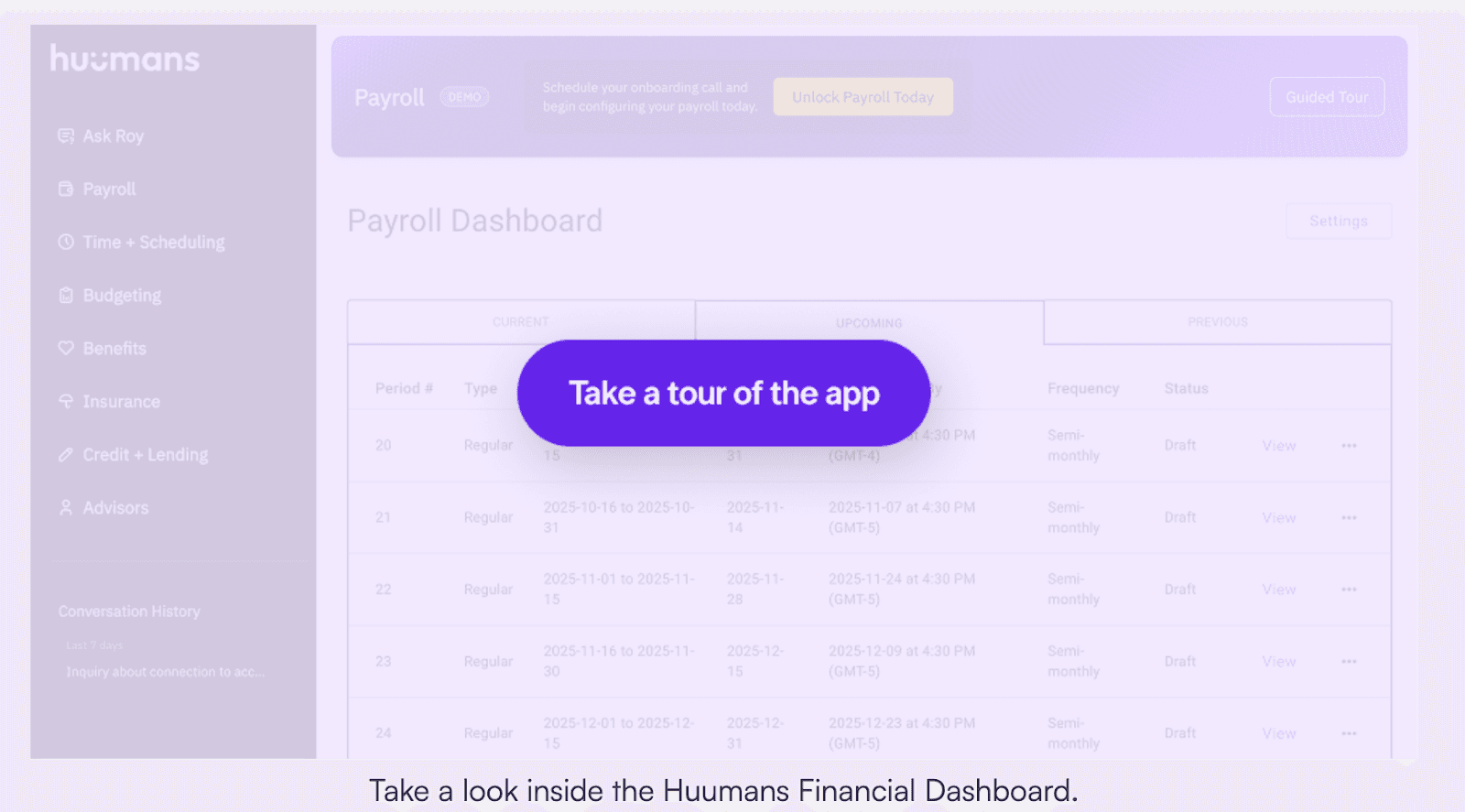

2. Is it hard to start using or switch to new payroll software?

We know you didn’t wake up this morning thinking to yourself, “I want to start using new payroll software.” But when we explained that, on average, a small business with fewer than 5 employees spends $1,500 on software and 144 hours trying to get payroll right, you stopped in your tracks. At the same time, many of you could also relate because, to the best of your knowledge, there simply isn’t a better answer.

That’s when you were really happy to hear that Huumans Payroll is offering free payroll for up to 5 employees for the first year. We’ll even help you get set up and on your way to saving time and sanity in 2026. We would like to ever-so politely add that the number of spots available before the start of the year is limited.

3. Does AI really make sense for small businesses?

We’ll start this answer with a question. Did you know that 66% of small business owners already use at least one AI-enabled tool? AI is already built into so many common applications that you may already be using it without even knowing it.

At Huumans, we’re 100% sure AI can help you better understand your financial data. That’s why we’ve built an AI advisor/CFO named Roy who’ll help you make more sense of what your numbers are actually telling you.

That same study that said you’re probably already using AI? It also found that 97% of small businesses using AI saw tangible benefits, like better clarity, and decision-making.

Our commitment: Making a real difference

As we head into the home stretch of 2025, we want to bring relief to Canadian small businesses, the unsung heroes of the national economy. That’s why we’re giving you the chance to use our software to pay up to 5 people free of charge for the next year.

In addition to putting your payroll on autopilot, you’ll also be able to share your payroll data with an AI-powered advisor who’ll help you make your numbers work for you. Roy can tell you what your trends are saying and walk you through what-if scenarios. But only time will tell who wins the World Series.