Day-to-Day

•

Jan 28, 2026

Michelle Mire

Now available: Simple, flexible working capital

When cash flow tightens, payroll timing shifts, or an opportunity appears, access to capital makes all the difference. But for many business owners, how that capital is accessed matters just as much as whether it exists at all. That’s why we’re introducing working capital advances inside Huumans

A much-needed change for the better

While small businesses drive Canada’s economy, their economic importance isn’t always reflected in how capital is allocated. Traditional finance providers, like banks, only allot around 16% of their credit portfolios, leaving many entrepreneurs underserved.

It’s reality that’s further complicated by time-consuming application processes and risk models that don’t fit small business reality. It’s also no wonder that nearly one third (31%)of small businesses are unhappy with the current financial provider landscape.

Capital powered by clarity and choice, not pressure

“Small businesses aren’t just craving change, they need better ways to get the funds they need to maintain cash flow and invest in growth,” says Kyle Stinson, Head of Partnerships and Growth at Huumans.

With working capital advances powered by Slate, you can apply for up to $50,000 in funding, get approved in as little as 24 hours, and have these funds direct deposited to your account within 1 to 2 business days.

“People are tired of providing financial statements, tax documents and business plans, only to wait weeks to know if they’re even approved,” says Scott Elliot, Co-Founder and CEO at Slate. “That’s why our term loan financing model only requires basic identifying and business banking information.”

How working capital advances work

To apply for a working capital advance inside Huumans, you’ll have to provide your legal business name, address, and contact information, along with a business banking account. You’ll also answer a few quick eligibility questions.

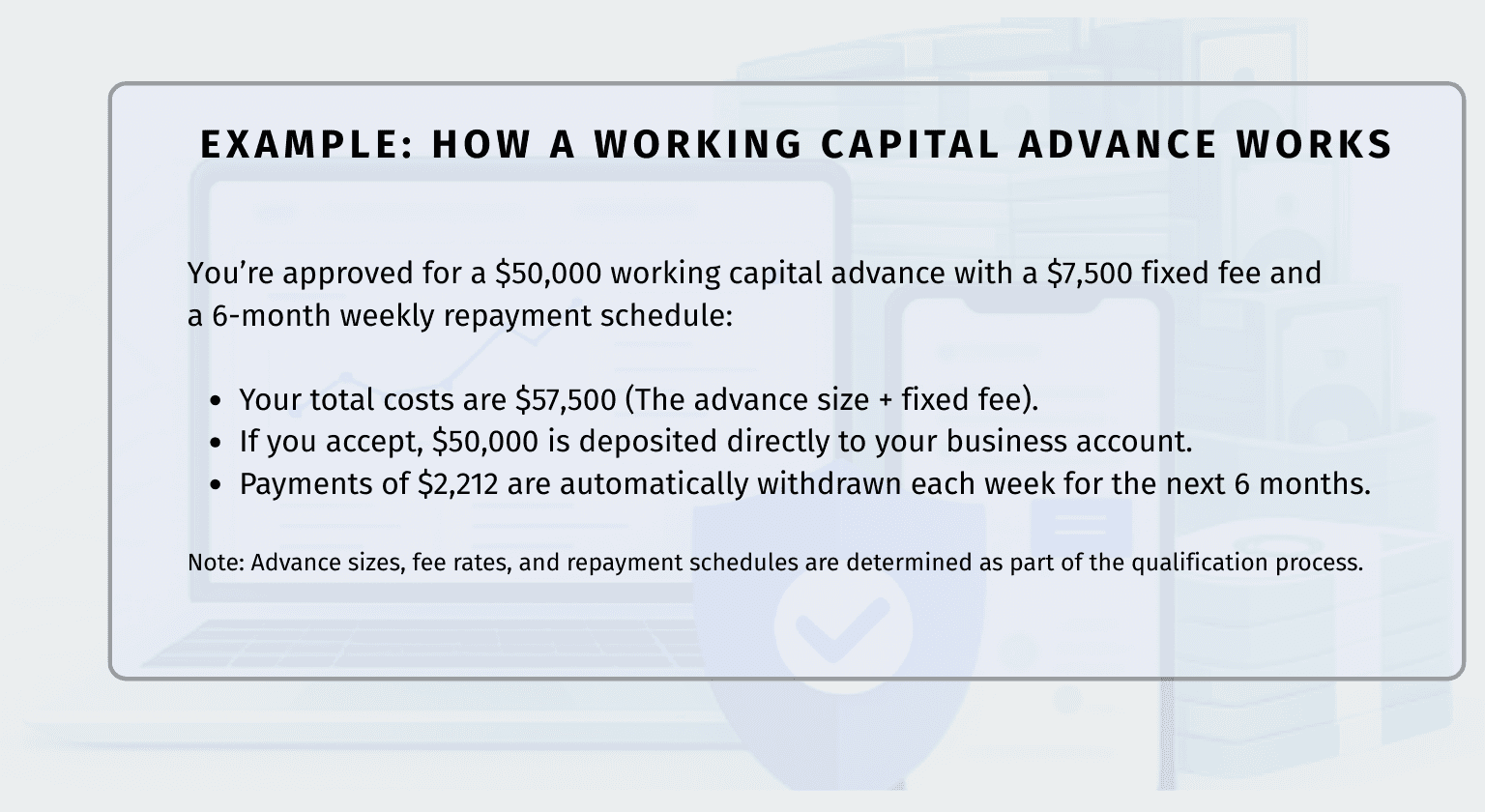

Once you submit your application, most businesses are approved within 24 hours. This means you’ll get your offer that includes the advance size, one-time financing fee, and payback period.

Know all your costs upfront

One of the main benefits of a working capital advance knowing all of the costs upfront with an offer that contains:

The advance size — as determined by your needs and your business financials.

The total costs — the advance size + a one-time fee.

The length of the payback period — typically 3 to 9 months.

Payments are made through Pre-Authorized Debit (PAD) payments, with no penalty for early payment.

After you accept the offer, your funds are deposited directly in your business account, in most cases within 1 to 2 business days. Even your repayments are automatically withdrawn based on your pre-arranged weekly or monthly schedule.

Here’s how to get started

Signing up for Huumans is fast and free. Once you’re inside, you can apply for your term loan. You can also get an instant financial overview, build a budget, and chat with a personal AI co-pilot.

Underwriting for working capital relies on two (2) primary data sources: business banking data and soft-pull credit check that doesn't impact your credit score.

Approval times, advance sizes, fees, and repayment schedules are determined by the approval process. Each process is unique to each business. Your business data will only be used for approval purposes. For more information, see the Terms of Service and Privacy Policy.

There’s no charge to access the Huumans operating system. However, sharing your financial data by connecting accounting applications like QuickBooks Online and Xero is required for the reporting and budgeting features. For more information, see Huumans Terms of Service and Privacy Policy.